texas tax back dallas

This is the law. When is Tax-Free weekend in Texas.

Texas Tax Back At The Galleria A Shopping Center In Houston Tx A Simon Property

214 653-7888 Se Habla Español Please click on any of the topics below for FAQs.

. How Does the Dallas County Property Tax Rate Compare. 214 653-7811 Fax. Right now Amazon has several great Back to School deals on pencils glue tape much more.

Apple Neiman Marcus Saks Fifth Avenue Macys Nordstrom Dillards and many other fine specialty stores. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. On Friday August 5 and runs through midnight on Sunday August 7.

PLUS dont forget its the Texas TAX FREE Weekend. The sales tax rate for these counties is 0 however the Dallas and Dallas MTA sales tax rates are 1 and 1 respectively meaning that the minimum sales tax you will have to pay in these four counties and the city of Dallas when combined with the base rate of. Back-to-school tax holiday August Designed to help Texans save on back-to-school purchases this tax-free weekend centers on school supplies clothing and more.

Our Texas Property Tax Consultants serving Dallas are here to help you navigate property sales and use and severance taxes on your business. Now Open - level 2. 80F OPEN 1000AM - 800PM.

Your average tax rate is 165 and your marginal tax rate is 297. The Dallas Morning News reports that the Texas Comptroller estimates that shoppers will save 112 million in sales taxes this weekend. Name of purchaser firm or agency Address Street number PO.

We are located in the finest shopping centers in Texas. 01-339 Back Rev7-107 Texas Sales and Use Tax Exemption Certification. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Contact a Tyler Dallas tax resolution attorney today to handle your back tax issues in Texas and resolve your IRS problems for good. You can expect to save about 8 for every 100 spent. Texas Tax Back at The Galleria - A Shopping Center in Houston TX - A Simon Property.

Property Tax Downtown Administration Records Building 500 Elm Street Suite 3300 Dallas TX 75202 Telephone. Submit your application to the Dallas County Appraisal District DCAD each year that you are eligible for the tax exemptions. That means that your net pay will be 45925 per year or 3827 per month.

We serve individuals and businesses throughout the State of Texas including Tyler Nacogdoches Marshall Longview Palestine Dallas Fort Worth Abilene Odessa Midland San Antonio and Plano. Eligible items you can buy tax free include. Oxford Twin Pocket Folders Letter Size Assorted Colors 25 per Box 998 Retail 1799.

Select clothing under 100. Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and 2023. At these shopping centers you will find your favorite stores including.

The rate increases to 075 for other non-exempt businesses. Records Building 500 Elm Street Suite 3300 Dallas TX 75202. If you make 55000 a year living in the region of Texas USA you will be taxed 9076.

San Antonio TX 78256. Failure to do so could result in the tax exemption not being renewed. Welcome to the Dallas County Tax Office.

15900 La Cantera Parkway. In 2022 it takes place Aug. The Tax Office locations below are closed to.

Box or Route number Phone Area code and number City State ZIP code. The form is below. This means that a single property will be advertised for one day each week for a total of three appearances not for three complete weeks.

This certificate does not require a number to be valid. 214 653-7811 Fax. A Austin BB Baybrook Mall CC Corpus Christi D Dallas EP El Paso FW Fort Worth GV Grapevine H Houston HG Houston Galleria HPO.

Select shoes under 100. In Texas a property cannot be sold at a Sheriffs sale or Constables Sale without first being advertised in a local paper for three consecutive weeks. The Texas Franchise Tax.

Select underclothes under 100. This year tax-free weekend starts at 1201 am. School backpacks under 100.

The average tax rate in. The Dallas County property tax rate is determined by the Commissioners Court and combined with the rates decided by your appraisal district based on an assessment of local property values. 214 653-7811 Fax.

Downtown Administration Records Building 500 Elm Street Suite 3300 Dallas TX 75202 Telephone. Here are a few of my favorite deals. 214 653-7888 Se Habla Español How do I apply for a refund for an overpayment or erroneous payment on my property tax account.

Dallas County Appraisal District DCAD requires that an annual application is made yearly for all applicable historic tax exemptions.

Texas Income Tax Calculator Smartasset

Top Texas Tax Preparer Service Impuesto Sobre La Renta Libro De Registro Hipotecario

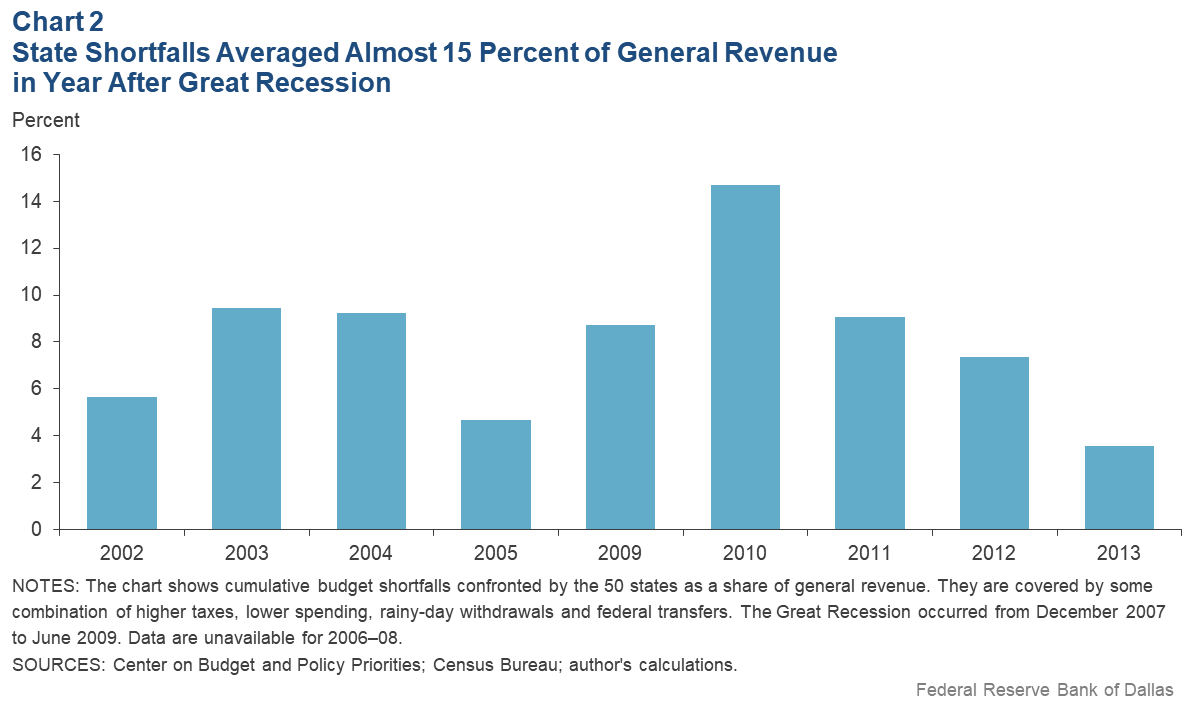

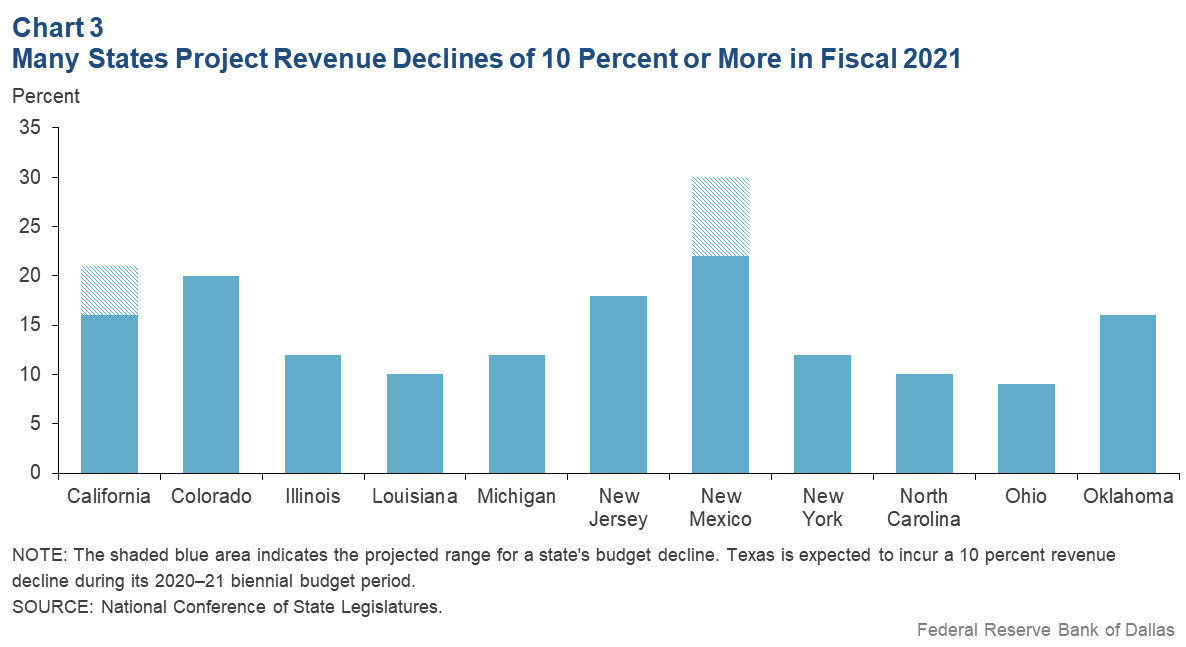

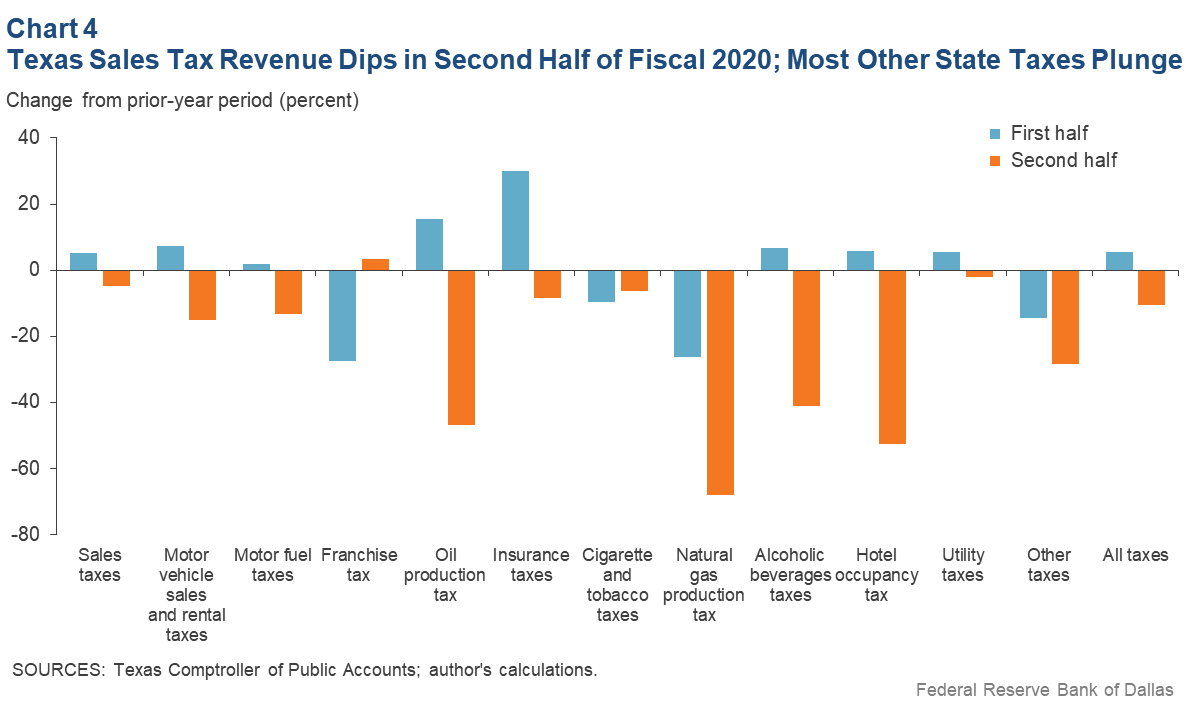

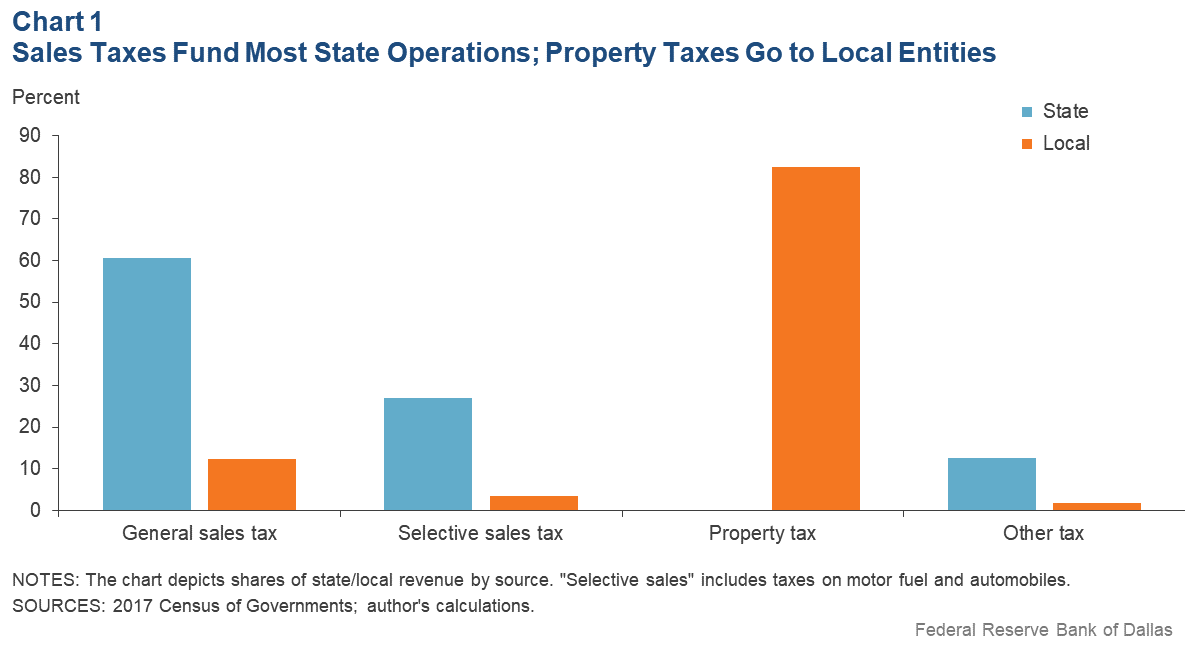

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Tax Free Weekend A Chance For Back To School Shoppers To Save Big Cbs Dfw

Tax And Accounting Services In Dallas Texas Digital Marketing Accounting Services Accounting

Texas Income Tax Calculator Smartasset

/cloudfront-us-east-1.images.arcpublishing.com/dmn/T2UD5TM7RRHXVJFXXO4RU5NVHI.jpg)

Dallas And 24 Texas Cities Sue Disney Hulu And Netflix For Streaming Fees

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease

Taxes International Students And Scholars Office

How To Get Tax Refund In Usa As Tourist For Shopping 2022

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Tax Free Weekend A Chance For Back To School Shoppers To Save Big Cbs Dfw

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

What All Is Tax Free This Weekend In Texas Nbc 5 Dallas Fort Worth

Texas Energy Star And Watersense Sales Tax Holiday Helps You Save Nbc 5 Dallas Fort Worth